Detailed Information Research

There are a lot of websites about second-hand car and numerous ways to trade. Buyers may get confused by these information but they should not make immediate decision before having deep consideration. Buyers may consider the characteristics of the second-hand car they like, whether the functions of the car suit their needs, their frequency and purpose of using car.

Car Inspection

Before purchasing a second-hand car, you should find a just, professional and independent vehicle inspection company to carry out car inspection which usually includes car testing, on hoist inspection, leakage inspection, suspension modification checking and certainly the checking to see if the car has undergone traffic accident or being crashed. The inspection takes approximately one hour, the vehicle inspection workshop will inform you about the condition of the car and assess the parts needed for repair or replace. Besides, as a buyer, you should buy the car with less used mileage, but meanwhile it depends on how the previous owner uses the car.

Incurred Legal Liabilities

The prospective buyer should go to the Transport Department and apply for the "Certificate of Particulars of Motor Vehicle" which lists out the name, identity document and the address of the car owner. It also includes the make of vehicle, year of manufacture, vehicle model, colour, engine serial number and chassis number of the car, which can help verify whether these information correspond with the particulars of the vehicle.

If you are the owner of the car and want to sell it to a third party, you should handle the transfer ownership procedures properly on all the documents related to car-selling, for example, both buyer and seller have to go to the Transport Department for the transfer ownership application. You should be very careful to handle all these procedures, you are advised to go to Transport Department immediately for the transfer ownership application after you receive the payment, or you may have to bear the civil and criminal legal liabilities of the car in the future.

Necessary Car Insurance

Purchasing car insurance is another important thing you have to do, you can choose to buy Third Party Insurance or Comprehensive Car Insurance depends on your need. Insurance company does not insure the owners against new-licence or age under 25 for high horse power and high torque performance car. You should check if the insurance company insure against the car model you want to buy.

Being a car owner, you should inform the insurance company and ask them how to handle the policy you purchased for the previous car or directly cancel the existing policy after you have sold the car.

Enhancement of Car Knowledge

The above inspection methods and notes are for your reference when you trade car. No matter the former owners or prospective owners of the car should understand that being an owner, you should be equipped with certain inspection skills and knowledge, because it is impossible to find professionals for thorough examination for all the cars you are interested in.

Lastly, Well Link Insurance wishes you all the best and an enjoyable driving experience.

Purchasing "Third Party Plus (TPP)" from Well Link Insurance, you can be compensated with repair cost / Market-value compensations for the insured car collided with any third party vehicle.

How Do Insurers Calculate Premium of Private Motor Insurance?

This is no universal benchmark on determining the premium of private motor insurance among different insurers. Dedicated to offering value-for-money private motor insurance solutions, WLI customises customer policy in a case-by-case manner. Premium level is based on the following criteria:

Age

Younger and or inexperienced drivers are generally considered higher risk, so a higher premium applies.

Track Record

In general, insurers assess the track record of a driver in the last two years. Drivers who have filed multiple claims or involved in multiple accidents are generally considered higher risk, so a higher premium applies.

No Claim Discount

For drivers who have never filed over the last year, a No Claim Discount on premium up to 60% applies for policy renewal.

Usage

Usage of an insured motor declared by the driver is directly linked to respective premium level. Accurate declaration is highly recommended.

Mileage

Insured motors with lower mileage and usage during peak hours are generally considered lower risk, so a lower premium applies.

Market Value

Market value of an insured motor is directly linked to respective premium level. The higher the market value, the higher the premium, and vice versa.

Engine Power

Engine power of an insured motor is directly linked to respective premium level. A higher premium applies on an insured motor powered by turbo engine, even with a lower engine power.

Excess

Excess refers to the amount an insured person is required to pay in the event of a claim, with its actual amount subject to policy's terms and conditions. The higher the excess amount, the lower the premium, and vice versa.

7 Simple Ways You Can Protect Yourself on the Road

Even the safest drivers are still at risk from third parties, mechanical failures and other road hazards. Just pay attention to the 7 advices as below for better managing the unexpected:

- Avoid using electronic devices while driving to eliminate potential road accidents caused by distraction.

- Always aware of speed limit to avoid speeding and following too close to the motor in front.

- Set a good example for other drivers by using your indicators.

- Avoid drink and drive. Either have a designated driver if you are going out or take a taxi to the next destination.

- Always buckle up and arrange child seats to ensure the safety of your passengers and your own.

- Avoid driving at night or rainy if possible to minimise accident risk.

- Perform regular maintenance on your motor and follow the measures as specified below:

- Arrange annual brake check and make timely replacement on damaged brake pad.

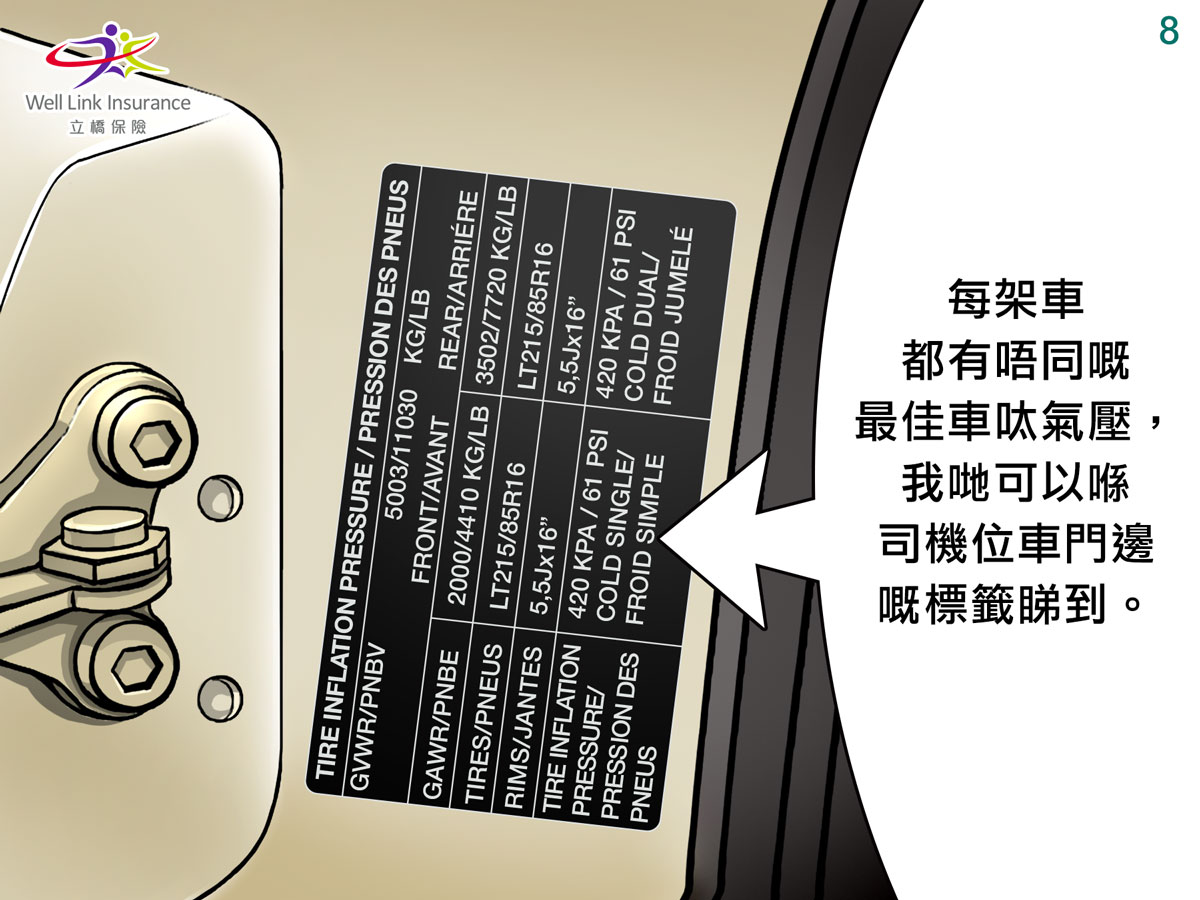

- Check air pressure in tyres every time when you get into your car, and replace in accordance with manual recommendation to avoid accident.

- Replace engine oil regularly to prevent engine failure and car stalls.

- Check timing belt regularly and replace in accordance with manual recommendation.

- Check your windscreen wipers regularly to ensure normal operation on rainy days.

- Choose a reputable workshop and pay the maintenance fee only when the motor has been properly repaired.

Glossary of Commonly Used Insurance Terms

For enquiries related to insurance terms, please call WLI Customer Care Hotline at +852 2884 8888.

A

Adjuster: A person who investigates and settles insurance claims

Agent: A person who sells insurance policies for an extra fee on top of your insurance policy

Authorised driver: A person authorised by the insured person to drive the insured motor

B

Bodily injury: Physical injury(ies) to a person

C

Cancellation: Termination of an insurance policy by the insurer or insured person before the renewal date

Claimant: A person who files claim on the private motor insurance

Collision coverage: Payment of maintenance cost from the insurer after deducting excess or compensation up to the actual cash value of the insured motor

Comprehensive coverage: Insurance which covers motor-related accidents, vandalism, theft, fire, flood or other natural disasters

Contract: A contract between the insurer and the policyholder, or an Insurance Policy in most cases

D

Deductible: The amount an insured person is required to pay in the event of a claim, with its actual amount subject to policy's terms and conditions. The higher the excess amount, the lower the premium, and vice versa

Depreciation: The reduction in the value of an asset over time due in particular to wear and tear

L

Lapse: Termination of a policy due to non-payment of premiums

Liability insurance: Insurance that pays for the injuries of other party(ies) or damages of other motor(s) resulting from an accident caused by the insured person or the authorised person driving the insured motor

Liability limits: The maximum amount your liability insurance will pay. For instance, the basic "25/50/25" coverage specifies the proportion of maximum compensation for each injured person (25%), per accident (50%), and property damage per accident (25%)

M

Main driver: The most frequent user of the insured motor

N

Named driver: A person included in the motor insurance coverage by the insured person

Non-renewal: A policy no longer renewed by the insurer

P

Policy period: The period from the beginning or effective date to the expiration date of an insurance policy

Premium: The amount you pay to an insurer to obtain or renew an insurance policy

Primary use: The main usage of the insured motor, such as private and leisure / commute / business uses

R

Rider: A written agreement attached to the policy expanding or limiting the benefits otherwise payable under the policy. Same as an Endorsement

S

Surcharge: An extra charge added to your premium by the insurer

U

Underwriter: A person who reviews and accepts an insurance application, and decides the premium level

Underwriting: The process which the insurer decides the acceptance or rejection of an insurance application

8 Travel Tips To Help You Get More Enjoyment From Your Trip

- Stop over-packing to avoid enjoying just the opposite of an effortless journey (see our travel checklist).

- Even when the journey does not meet your expectations, always stay positive and keep an open mind for embracing pleasant surprises ahead.

- Keep your daily schedule light for not rushing from activity to activity and missing the many panoramic views in between.

- Opportunity makes a thief. Try not to flash your valuables during the journey.

- Be reasonably adventurous for enjoying invaluable travel experience. Safety is always of the utmost importance

- Never blindly trust the locals. Think twice even if it is as simple as looking up directions.

- Books should be read with reservation. Guidebooks of your destination can be outdated as soon as they are published. Let's enjoy the journey by heart.

- Rest assured with the purchase of value-for-money travel insurance, and never be bewildered for managing the unexpected loss of baggage, delay or cancelation, medical emergency, etc.

Beware of 7 Common Scams

1. Fake Police

Beware of someone posing as the police (and even real police in some countries) will suddenly stop you, demand to see your passport, make an accusation and immediately offer to solve your troubles with a fine. Always ask to go with them to the police station and they will back down.

2. Shopping Scam

If you have been dropped of anywhere by an enthusiastic tuk tuk or rickshaw driver, beware. Chances are you are just an inch away from shopping scams.

3. Taxi Scam

Taxi scams are perhaps unpreventable - the taxi driver may even threat to kick you out on the side of the road. Always take a taxi at official taxi stands, or agree on the taxi fare in advance. Never pay the taxi until you arrive and get a receipt before taking off.

4. Fake Shutdown

When asking about everything from sites to hotels to restaurants, a common scam is the local taxi driver, street vendor or other tell you the destination is closed, and instead make a counter offer, better pass rather than take.

5. Scooter Scam

Riding a scooter for a day around the countryside and suddenly the scooter you are riding breaks down, always take photos of the failed scooter and seek second opinions on repairs. Otherwise the scooter owner may escort you to his preferred workshop for maintenance and insist you to cover the overinflated costs with threats of violence or police action.

6. Scooter Theft

Park your rented scooter carefully when you are riding around the city. Someone working for the leasing company may steal your scooter, and the owner will set a trap for requesting hefty compensation. If you handed them your passport and signed a contract, you are obligated to pay for it. Carry your own lock and key along with an old passport to avoid getting sucked into this scam.

7. Pickpocket Excuses

Beware of any confusion, bumping, or a surprising splat followed by a helpful stranger helping you to clean up. This aims at distracting you to create a close contact for pickpocketing your valuables.

Before you set off, make sure you have packed everything you need.

The Essentials

- Passport (and visa if required)

- Frequent Flyer Cards

- Emergency Information

- Currency

- Credit Cards

- Travel Insurance

- Personal Identification

- Copies of Tickets/Passport, etc.

- Special Event Reservations

- Health Documentation

- Hotel Reservations

- Cell Phone

Before You Leave

- Advise Bank of future spending with credit card aboard

- Arrange mail pickup or supension

- Advise home alarm company

- Turn off water

- Arrange pet and plant care

- Leave house key and itinerary with a neighbour

- Empty refrigerator

- Unplug appliances

- Lower thermostat (if no pets)

- Turn off hot water heaters

- Lock all doors and windows

- Pre-pay bills

- Reconfirm flights with airline

Day to Day

- Clothes

- Raincoat/Umbrella

- Shoes (dressy and comfortable)

- Hat

- Camera, Lenses, Film/Memory

- Battery Chargers

- Water Bottle

- Hand Sanitizer/Towelettes

- Guide Books and Maps

Travel Bags

- Main Travel Bag

- Daypack/Duffel/Carry-On

- Money Belt

- Daily bag

Toiletries

- Comb/Brush

- Toothbrush/Paste

- Antiperspirant

- Soap

- Lotion

- Makeup

- Razors/Shaving Cream

- Hair Dryer

- Towel/Washcloth

- Travel Bottles (for liquids)

It is common that motorcyclists refrain from motorcycling in the rain, but sometimes this is just inevitable due to duties or unexpected rain. Special care must be taken under such circumstances though no data shows greater risks of road accidents to motorcyclists in the rain.

Slippery road surface from rainwater minimises friction between tyres and ground, making your motorcycle vulnerable to skidding and loss of control. Conditions are particularly worse when rainfall just begins because rainwater flushes out grease and dusts on the road surface. Low visibility in the rain also undermines a motorcyclist's observation and judgement.

Gear

Besides staining the helmet and face shield, rainwater also lowers temperature of the face shield causing fog on the inner side which affects vision and causes danger. To add anti-fog effect to non-fogproof face shields, fogproof and waterproof sprays would be a good idea. To do so, spray the content onto a spectacles cleaning cloth and wipe the inner side of the face shield, then apply waterproof spray to the outside. This prevents fog from building in the inner side and dispels rainwater which falls on the shield surface in the form of water drops. Besides, raincoat and rainproof trousers, skidproof gloves and rainboots (or waterproof overshoes) are also essential parts of your gear to drive in the rain.

Driving skills

Pedal control: Due to weaker friction and adherence of tyres to wet road surface, skidding is vulnerable in case of improper pedal control, sudden acceleration or deceleration.

Braking: You should start braking earlier than usual with proper pressure and speed for a smooth halt.

Making a turn: Slow down before entering a turn and keep the speed when curving. Shift the center of gravity with aid of your body as far as possible. Keep car body to the least possible tilt and provide greater surface of contact and better distribution of weight between tyres and road surface.

Tyres and shockproof

Hydroplanning is common in case of deep water or excessively high speed. Hydroplanning occurs when water builds between the wheels and road surface and cannot be channeled out. The water pressure floats the tyres slightly so they move on water on the road, leading to a loss of control. The tyre pattern mainly serves to channel out water and increase grip to wet road surface. It is stipulated in the laws of Hong Kong that a tyre must have grooves with minimum depth of 1mm, but 3mm is generally suggested to ensure considerable capacity of water channeling for stability and secure road grip. A driver should pay attention to depth of tyre grooves. Consideration may also be given to adjusting the shockproofing setting. Minimize the spring preload and pressure can achieve softer shockproof to help increase road grip.

Pay attention to road conditions

Avoid puddles of water as far as possible. When moving across manhole covers, road signs or metal plates, the front tyres may skid causing the motorcycle to move beyond the lane. To avoid skidding, do not tilt the car body or apply the brake. Cross any tram rails in a diagonal line instead of in a relatively balanced way.

*Source: Occupational Safety & Health Council, iBike.com.hk, BikeHK.com

Considerable risks are involved to drive on a rainy day. The above is not an exhaustive list of points to note. No motorcycling on rainy days is recommended as far as possible. If you must do so, please consider how to protect yourself such as with comprehensive motorcycle insurance.

Well Link Insurance offers "comprehensive motorcycle insurance" with choice of optional benefits such Personal Accident and Medical Expenses.

You might have heard people saying they want to have a slim body - just like how Korean pop stars look like. There is no doubt that having a sexy and slender body is everyone's dream – however, it is even more important to know that obese people usually have higher risks in suffering from other hidden diseases. Obesity increases the risk for a number of chronic diseases, such as hypertension, heart diseases, hypercholesterolaemia, diabetes mellitus, cerebrovascular disease, gall bladder disease, osteoarthritis, sleep apnoea and some types of cancer (breast, prostate, colorectal and endometrial).

*Source: Centre for Health Protection (CHP) of the Department of Health

On the other hand, being underweight could be equally worrying – they are usually suffering from osteoporosis and anemia. Few years ago in the US, a health study was conducted among more than 3000 women and, it was found that the chance of slim women suffering from hip fracture is more than double when comparing with women at normal weight. The reason for that is because people who are underweight tend to lack estrogenic hormone in their bodies, which would affect the integration between calcium and bones and could result in low bone density and higher chance of osteoporosis and bone fracture.

Body Mass Index (BMI)

Through understanding the concept of Body Mass Index (BMI), we would know what is the ideal body weight. BMI is an index for body height and weight, and it is an internationally recognized approach for assessing fatness of an adult.

Calculating BMI = Body Weight (kg) / Body Height (m) 2

Serious Health Risk Chart

Many studies have proven that the higher the BMI is, the risk of suffering from diseases and death would rise accordingly. Below is a chart showing the level of BMI and the risk of suffering from serious health problems:

*Source: Hospital Authority – Health InfoWorld

No matter being obese or underweight, one must not forget the regular body check. It is worth noting that nowadays, many people are suffering from different kinds of diseases, which indeed could lead to outrageous medical fees for those who are suffering from sickness. To plan ahead for yourself and family, highly recommend everyone to purchase health insurance in advance.